A Demat account additionally called a “Dematerialized account”, assists all clients with putting away their monetary protections like bonds and offers in an electronic organization.

The capability of the Demat account is like another financial balance. The main essential contrast between an investment funds ledger and a Demat account is financial balance holds the cash electronically while a Demat account is utilized to electronically hold every one of the claimed shares and different protections with Refer And Earn Demat Account.

A demat account is the most ideal way to involve it for exchanging, effective financial planning, holding, and different methodology of web-based exchanging financial exchange.

It assists every one of the financial backers with purchasing and selling shares, stocks, common assets, and government protections with next to no desk work required.

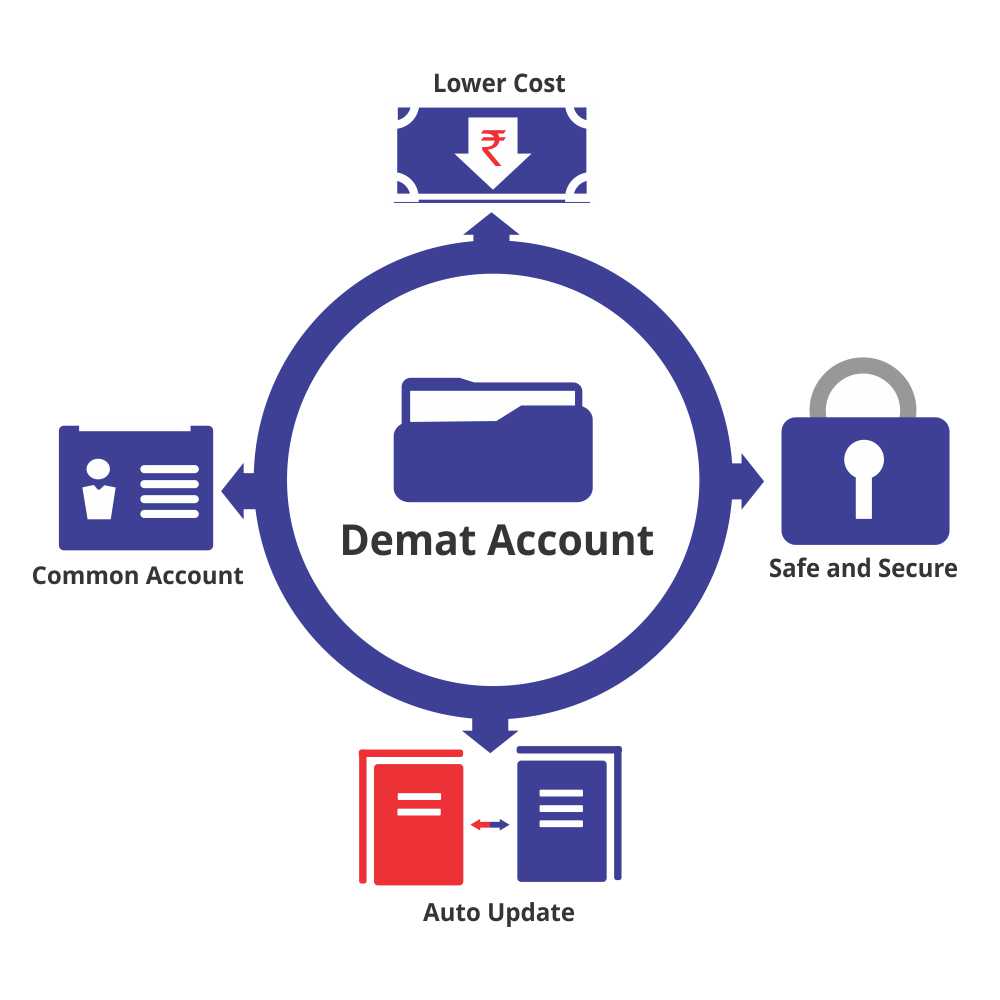

Highlights of Opening a Demat Record

There are a few fundamental highlights of a Demat account that assist a few clients with making their monetary exchanges more straightforward:

Simple Offer Exchanges

Clients can undoubtedly move their portions quickly with the assistance of a Demat account. In this manner, having a Demat account makes the entire cycle more straightforward and a lot quicker.

Moreover, moving the protections starting with one Demat account and then onto the next should be possible through conveyance guidance slip (DIS) or receipt guidance slip (RIS).

Both these slips will permit clients to fill in every one of the significant and important subtleties for doing an exchange in a smooth way.

Freezing Demat Record

The Demat Record holder has the ability to freeze the specific sort or amount of protections in a Demat account.

They likewise reserve the privilege to decide to freeze their Demat to represent a particular time frame. By freezing, it will prevent the exchange of cash from any Credit or Check cards into a particular Demat account with Refer And Earn Demat Account.

Simple Dematerialization of Protections

Assuming a financial backer is holding its declarations in actual structure, they need to give point by point guidelines to the vault member (DP) to change them into an electronic structure.

Essentially, assuming that a financial backer is holding its endorsements in electronic structure, it tends to be handily changed over into actual structure by mentioning it.

Moment Access

The significant advantage of having a Demat account is that it gives fast and simple admittance to all their venture and proclamations with the assistance of net banking.

Likewise, these subtleties can be effectively open through a cell phone, PC or some other electronic gadget anyplace.

Getting Advantages and Stock Profits

The presentation of the Demat account has helped a few clients a ton. It is on the grounds that they have supplanted the tedious interaction with straightforward and simple strategies to get interest, assets or profits.

Those assets or profits are consequently credited to the Demat account. With regards to refreshing the financial backer’s record, with extra issues, stock parts, public issues, the course of a Demat account is very helpful in light of the fact that it is finished through an electronic clearing administration (ECS).

Globalizing India

Demat Records play had a fundamental impact in allowing an opportunity to unfamiliar financial backers to get moment and simple admittance to the Indian Securities exchange. Likewise, the critical ascent in unfamiliar cash in the securities exchange has helped the clients and the Indian economy with Refer And Earn Demat Account.

Comments are closed.